How to Make the Most of Your Home Maintenance Budget

It is important to budget for all ongoing and one-time expenses when planning to buy a home. A first step in doing this effectively is to estimate the costs that will be incurred during your time in your house. When it comes to the cost of home maintenance, here are a few things that every homeowner should be aware of:

- Lawn care and cleaning services

- Improvements such as installing central air conditioning or specialty flooring items used throughout the home

- Furniture, art, and appliances

- Utilities

Consider any factors that may have an impact on these prices at different seasons of the year. Electricity costs are frequently highest in the summer and winter, when it is most in demand. These things are also significantly influenced by location; nevertheless, for a more accurate value, average it across a year. Consider these factors when budgeting for your property to obtain a better understanding of what your maintenance costs will be.

MAKING A PLAN AND DETERMINING HOW MUCH YOU NEED TO SAVE

Many homeowners’ long-term home improvement plans will include home maintenance items. But how much should you put aside for house maintenance? That is the question that many homeowners will be asking.

Before you begin saving for home maintenance, it is necessary to recognize that professionals generally recommend having a maintenance fund equal to 2-3% of your property’s value. Repairs can cost thousands of dollars over several decades when factoring the average lifespan of furnishings and normal wear and tear.

It is advised that you try to save money on a monthly basis, and that if you already have savings, you put money away in a lump sum. This can assist kickstart your home improvement fund, seed it, and provide you more options when it comes to home maintenance, renovations, or replacements.

When it comes to house improvements, the general rule is that you should never pay out of your home equity. Instead, save money and only use home equity as a last resort if you don’t have enough saved. It is not advisable to use your home equity for small repairs because it gives no potential home value. Larger projects, such as home renovations, can make more sense because they boost the value of your property, which you can then use to sell your home or use as collateral for other investments. The issue with utilizing it on smaller items is that if you need to fix them again in a few years, you’ll have no home equity left!

Focus on saving money for house maintenance on a monthly basis to guarantee you have the finances when you need them. Keep your property in good condition while saving for larger repairs such as renovations. By determining how much you should save each month in order to meet your objectives. Maintain full coverage house insurance as always to ensure that unforeseen bills are easily paid.

CREATING A TIMELINE BY TAKING INVENTORY OF YOUR CURRENT SYSTEMS AND APPLIANCES

When making a home maintenance budget, it’s critical to take inventory of all home systems and appliances, as well as their current state, to have a better idea of how much you’ll need to spend on house repairs and maintenance in the future. Make a timeline for your maintenance goals to ensure that you meet them on time.

Home maintenance may not be the first thing that comes to mind when you think of completing chores around the house, but it is just as significant as the home-buying process. Home buyers are sometimes so focused on their home inspection that they overlook the timetable of home systems and appliances.

Creating a home maintenance timeline might also assist you in keeping track of when improvements should take place in the property. When constructing a home maintenance timeline, begin with the most important maintenance jobs and work your way down as follows:

- Age of roof

- Age of HVAC

- Age of plumbing

- Appliances

You’ll want to know the age of these items because buying an older property often means dealing with outdated systems and appliances that need to be updated or replaced. Knowing the age of your roof, heating system, plumbing system, and appliances can allow you to create an effective home maintenance plan.

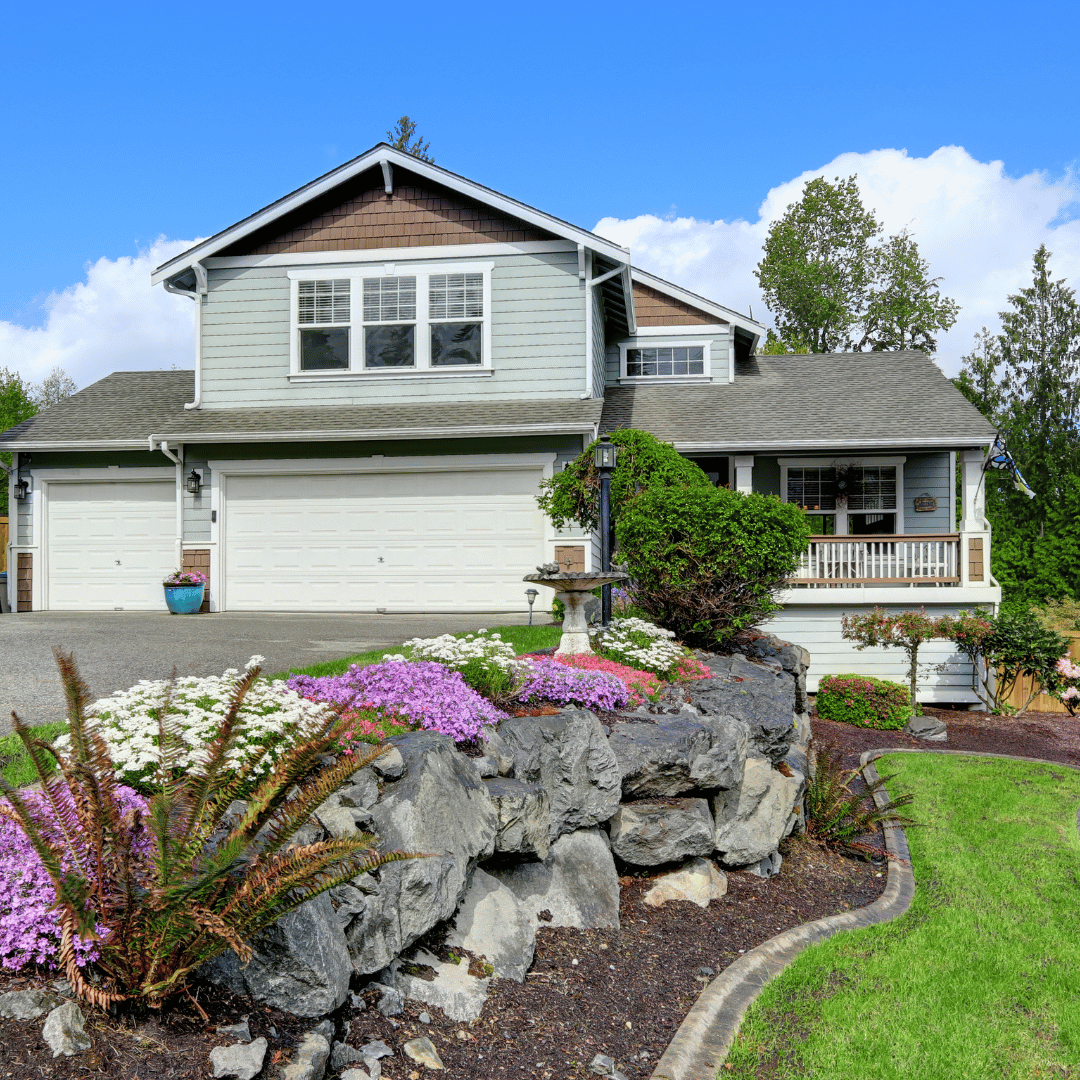

There are various aspects of home care that homeowners do not typically consider when acquiring a property. The exterior is an important element of any home, and it should not be overlooked in your inventory plan. Many items should be thoroughly inspected if your home has a brick or siding exterior.

In addition to taking inventory of your home’s appliances and systems, take note of the existing weather conditions in your location to assist you evaluate what type of heating system will work best for your home. The same is true for air conditioning—when the weather begins to change, it is a good opportunity to inspect annual maintenance on your current system, but take note of what type of environment you have before purchasing in a unit that will not adequately service your home.

- Siding Washing: The Ultimate Guide to Cleaning and Maintaining Your Home's Exterior

- Why Battery Operated Smoke Detectors and CO Alarms Are Crucial

- Elevate Your Home's Curb Appeal with HomeSmiles

- Best No Streak Window Cleaner: Tips and Techniques for Crystal Clear Windows

- A Complete Guide on How to Remove Stains from Concrete Driveways